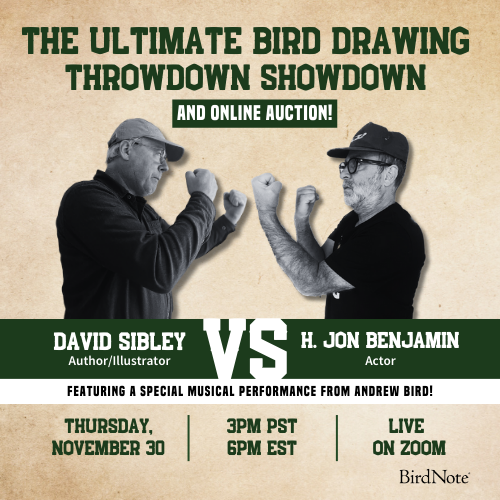

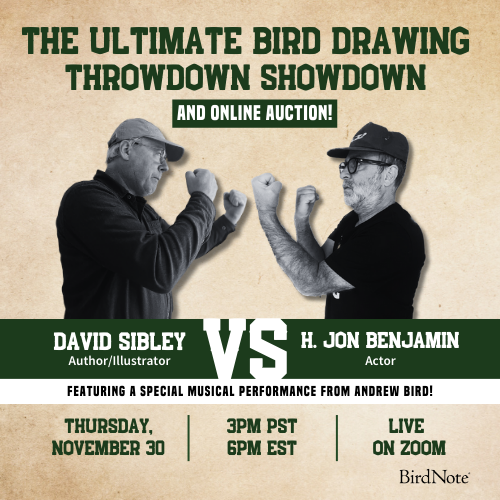

Join BirdNote tomorrow, November 30th!

Illustrator David Sibley and actor H. Jon Benjamin will face off in the bird illustration battle of the century during BirdNote's Year-end Celebration and Auction!

Many BirdNote listeners tune in to the radio to hear our stories on their morning commute, so we know how meaningful car rides can be. But if it’s time to say goodbye to a cherished vehicle that's given you countless hours of BirdNote stories, why not make sure it goes to a great cause? Donating your car, truck, trailer, boat or other vehicle to BirdNote is easy, free and tax-deductible!

BirdNote has partnered with CARS (Charitable Adult Rides & Services), a 501(c)(3) nonprofit that helps thousands of nonprofit organizations in the U.S. and Canada raise money through vehicle donation programs to offer another option for supporters who want to donate to BirdNote. Donating your vehicle is easy and completely free to the donor, and the CARS Vehicle Donor Support Team can walk you through each step of the process, from completing the initial form to pick-up of the vehicle.

Donating your vehicle starts with completing this form. Or, call 855-500-RIDE (7433)

All vehicles are considered! CARS strives to accept all types of donated vehicles (running or not) including cars, trucks, trailers, boats, RVs, motorcycles, campers, off-road vehicles, planes, heavy equipment, farm machinery, and most other motorized vehicles.

There is no cost to the donor. All expenses are deducted from the gross sales price, and if the costs ever exceed the price, those costs are covered by CARS.

Here are some great reasons to donate your vehicle to BirdNote:

- Donating is easy and the pick-up is free.

- Donating skips the costs and hassles associated with selling a car, like paying for advertising and insurance, or for car repairs to keep your car in running condition while you wait for a buyer.

- Donating avoids the costs associated with keeping a car, such as registration, insurance, car repairs, and more.

- You can free up space at home and/or stop paying for extra parking.

- It's better than a low trade-in offer.

- Vehicle donations are tax-deductible, and you could reduce your taxable income when taxes are itemized.

- Donating to a nonprofit feels good and makes a difference.

For answers to some commonly asked questions, visit this page.